Be Energy : Solutions Batteries Plus

LEAD-ACID BATTERIES

The industrial potential of lead-acid batteries in France

France’s stock of lead batteries represents a strategic industrial resource that remains largely untapped in terms of regeneration. France has an estimated stock of between 795,000 and 970,000 tons, with an annual renewal of 154,000 to 209,000 tons. This stock represents a veritable “urban mine,” structured, recurring, and perfectly tracked by regulations on waste electrical and electronic equipment (WEEE).

These characteristics make France a prime location for the deployment of industrial solutions for regeneration, reuse, and reconditioning, complementing an already efficient but functionally destructive recycling system.

Three key segments:

three opportunities for immediate value creation

Lead-acid batteries cover most of the demand for backup power and slow electric mobility. This market focuses on three segments representing more than 150,000 tons of identified annual flows:

Starter batteries (SLI)

140,000 to 180,000 tons/year

-

Approximately 40 million 12V batteries in circulation (700,000 to 800,000 tons installed).

-

8 to 10 million units replaced each year.

The issue : It is the largest and most homogeneous deposit, ideal for mass industrialization of regeneration.

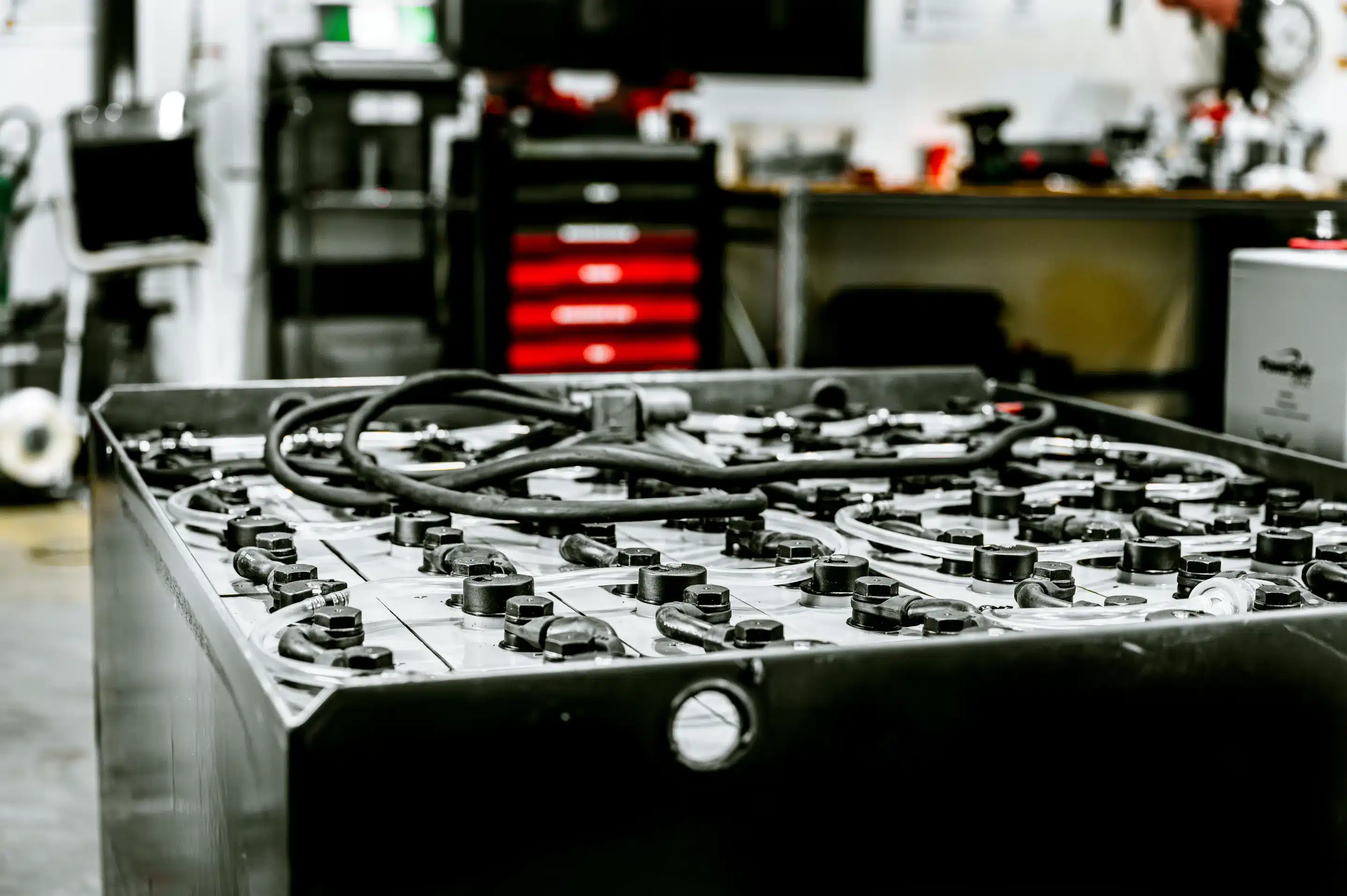

Logistics and industrial traction

10,000 to 20,000 tons/year

-

300,000 to 400,000 PzS lead batteries in service (60,000 to 100,000 tons installed).

-

High-capacity unit batteries weighing several hundred kilograms.

The issue : These robust batteries have a high residual value, making regeneration extremely cost-effective for forklift fleet managers.

Stationary – telecoms, data centers, hospitals, UPS

4,000 to 9,000 tons/year

-

35,000 to 70,000 tons installed at critical sites.

The issue : These batteries are subject to strict preventive replacement protocols. Regeneration helps secure these infrastructures while extending the life of technically sound assets.

Why regeneration is the new standard for profitability

The French market is dominated by massive volumes held by structured professional players. Against a backdrop of pressure on raw materials and energy transition, regeneration is emerging as the missing link in the value chain :

-

Preservation of value : Unlike recycling, which occurs after the object has been destroyed, regeneration takes place upstream to restore electrochemical capacity.

-

Decarbonization impact : Extending the lifespan avoids the manufacture of new batteries. 1 ton of regenerated batteries saves around 3 tons of CO₂.

-

Sovereignty : Reducing dependence on imports of new lead by optimizing the existing stock on national territory.

Waste reduction

Extending the life of valuable metals such as nickel.

Financial savings

Regenerating your battery costs on average

50% less than buying a new one.

CO2 emissions

Up to 80% less CO2 compared to manufacturing a new battery.

Preservation of natural resources

Focus on repair rather than extraction of new resources.

Turn your old batteries into savings and positive impact

Don’t just recycle what can still be used. By integrating industrial regeneration into your operating cycle, you can leverage three major benefits :

-

Immediate reduction in your operating costs (OPEX) : Cut your battery replacement costs in half by extending their life cycle by up to 100%.

-

Acceleration of your CSR strategy : Demonstrate your commitment to the circular economy by achieving measurable and certified CO₂ savings.

-

Enhanced reliability : Thanks to a technical audit and preventive regeneration, you eliminate the risk of critical failures due to premature sulfation.

Ready to audit the potential of your landfill ?

Contact our experts for a personalized analysis of your facility. Together, let’s move from waste management to sustainable asset management.